Resumo:

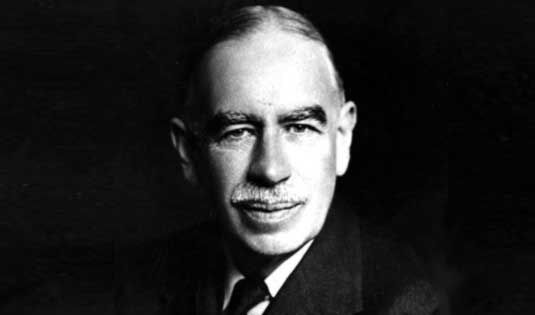

The risk-return characteristics of art as an asset have been previously studied through aggregate price indexes. By contrast, we examine the long-run buy-and-hold performance of an actual portfolio, namely, the collection of John Maynard Keynes. We find that its performance has substantially exceeded existing estimates of art market returns. Our analysis of the collection identifies general attributes of art portfolios crucial in explaining why investor returns can substantially diverge from market returns: transaction-specific risk, buyer heterogeneity, return skewness, and portfolio concentration. Furthermore, our findings highlight the limitations of art price indexes as a guide to asset allocation or performance benchmarking.

Fonte: David Chambers, Elroy Dimson, Christophe Spaenjers, Art as an Asset: Evidence from Keynes the Collector, The Review of Asset Pricing Studies, , raaa001, https://doi.org/10.1093/rapstu/raaa001