Resumo:

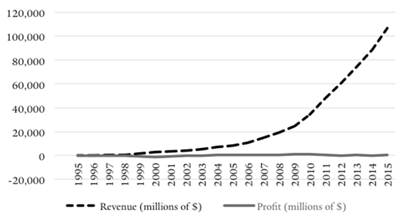

American jurisprudence considers price predation a largely irrational, and therefore self-limiting, business strategy which is unlikely to lead to monopolization of an industry. This paper argues that the recent rise of the negative cash flow firm upends traditional assumptions. These types of firms can achieve greater market share through predatory pricing strategies that involve long-term below average variable cost prices. It also maintains that recoupment, an essential element of any predatory pricing scheme, can be achieved without a raise of prices post predation. By charging prices in the present reflecting future lower costs based on prospective technological and scale efficiencies, these firms are able to rationalize their predatory pricing practices to investors and shareholders. These observations lead to the conclusion that price predation is a rational strategy which can foreseeably lead to monopolization. This paper then moves on to examine the conduct of Amazon, the biggest negative cash flow firm in the world. It suggests that not only is it entirely rational for Amazon to engage in price predation and a long-term strategy of monopolization but that under current corporate disclosure rules such conduct would be virtually undetectable. The negative impact of this behavior is the elimination present and future competition.

Shaoul Sussman; Prime Predator: Amazon and the Rational of Below Average Variable Cost Pricing Strategies Among Negative-Cash Flow Firms, Journal of Antitrust Enforcement, , jnz002, https://doi.org/10.1093/jaenfo/jnz002