Não tem a ver com preguiça, mas com medo.

(Há legendas em português)

18 junho 2016

17 junho 2016

Links

Mecanismo de recomendação da Netflix vale 1 bilhão

Excesso de plástica de Meg Ryan e a batalha da idade (foto)

Por cinquenta anos, vendeu a informação da hora correta

Menino de 12 anos fala da ligação entre vacina e autismo (vídeo)

Mundo Louco: Enquanto atirava, pesquisa notícias sobre o crime no Facebook

Excesso de plástica de Meg Ryan e a batalha da idade (foto)

Por cinquenta anos, vendeu a informação da hora correta

Menino de 12 anos fala da ligação entre vacina e autismo (vídeo)

Mundo Louco: Enquanto atirava, pesquisa notícias sobre o crime no Facebook

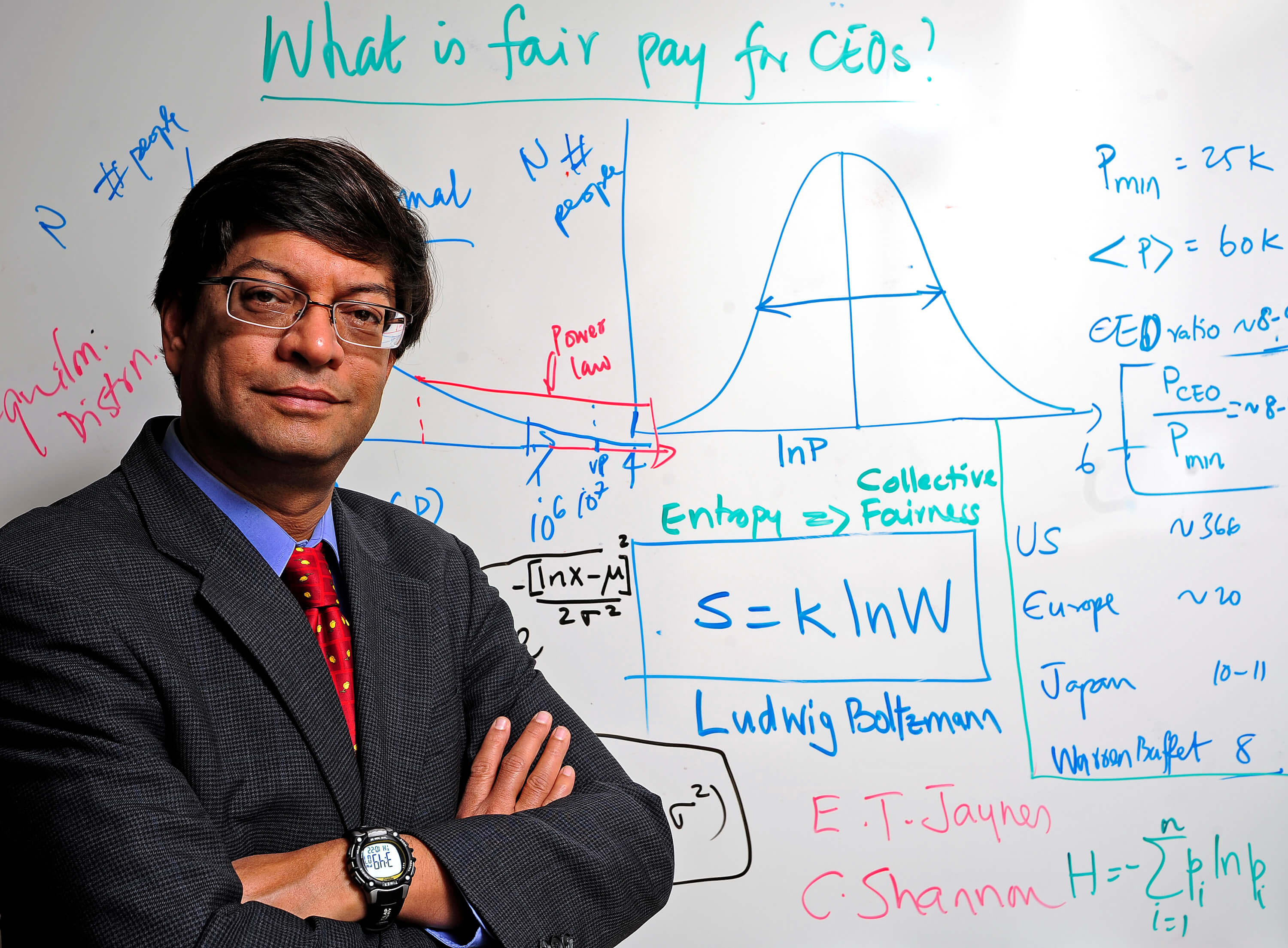

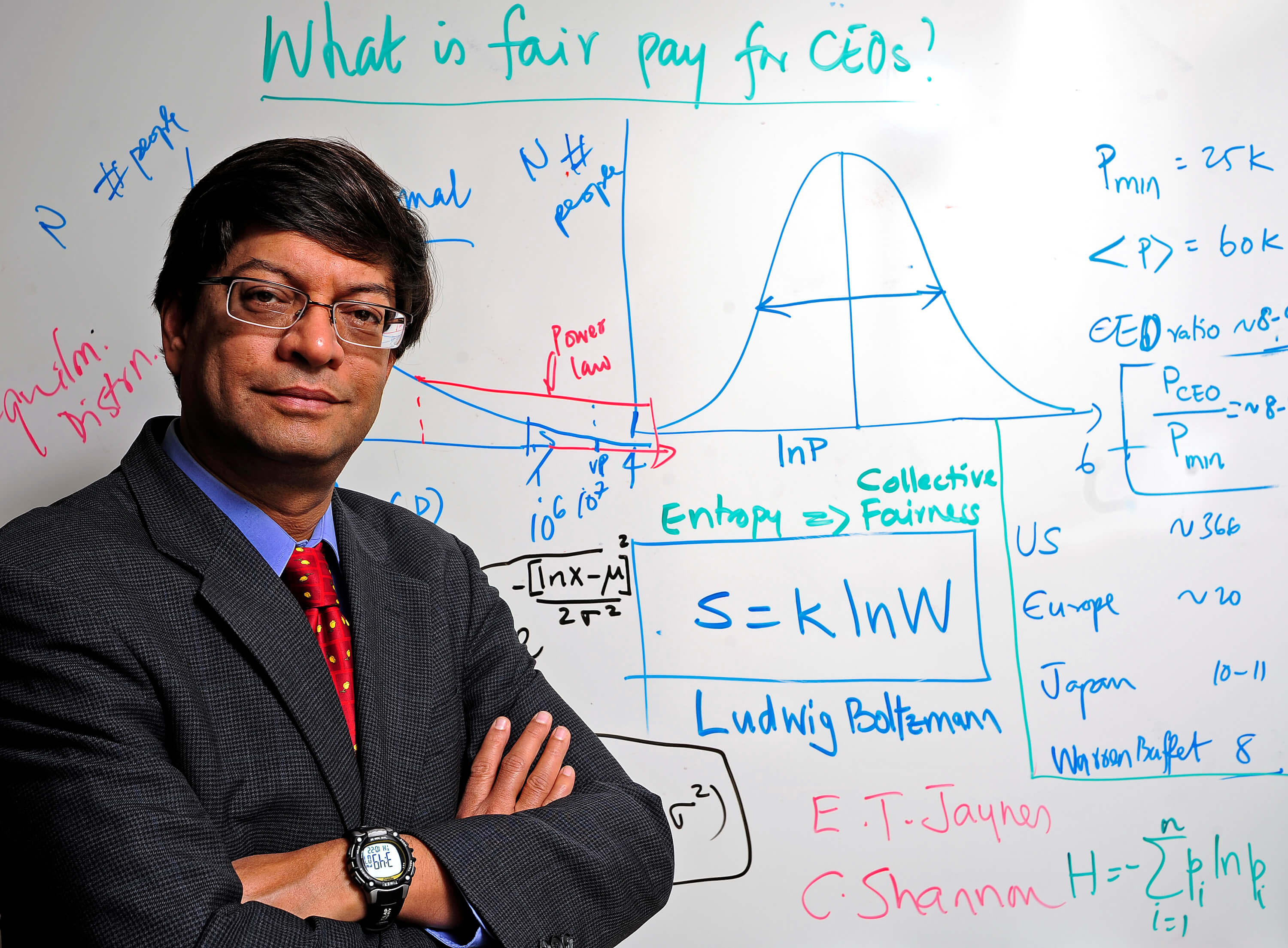

Econofísica x Economia Financeira: similitudes e diferenças

Resumo:

In line with the recent research and debates about econophysics and financial economics, this article discusses on usual misunderstandings between the two disciplines in terms of modelling and basic hypotheses. In the literature devoted to econophysics, the methodology used by financial economists is frequently considered as a top-down approach (starting from a priori “first principles”) while econophysicists rather present themselves as scholars working with a (empirical data prone) bottom-up approach. Although this dualist perspective is very common in the econophysics literature, this paper claims that the distinction is very confusing and does not permit to reveal the essence of the differences between finance and econophysics. The distinction between these two fields is mainly investigated here through the lens of the Efficient Market Hypothesis in order to show that, in substance, econophysics and financial economics tend to have a similar approach implying that the misunderstanding between these two fields at the modelling level can therefore be overstepped.

Fonte: On the "usual" misunderstandings between econophysics and finance: some clarifications on modelling approaches and efficient market hypothesis- Marcel Ausloos, Franck Jovanovic, Christophe Schinckus. 2016

In line with the recent research and debates about econophysics and financial economics, this article discusses on usual misunderstandings between the two disciplines in terms of modelling and basic hypotheses. In the literature devoted to econophysics, the methodology used by financial economists is frequently considered as a top-down approach (starting from a priori “first principles”) while econophysicists rather present themselves as scholars working with a (empirical data prone) bottom-up approach. Although this dualist perspective is very common in the econophysics literature, this paper claims that the distinction is very confusing and does not permit to reveal the essence of the differences between finance and econophysics. The distinction between these two fields is mainly investigated here through the lens of the Efficient Market Hypothesis in order to show that, in substance, econophysics and financial economics tend to have a similar approach implying that the misunderstanding between these two fields at the modelling level can therefore be overstepped.

Fonte: On the "usual" misunderstandings between econophysics and finance: some clarifications on modelling approaches and efficient market hypothesis- Marcel Ausloos, Franck Jovanovic, Christophe Schinckus. 2016

Teste de Significância na pesquisa contábil: críticas e sugestões

Resumo:

This paper advocates abandoning null hypothesis statistical tests (NHST) in favour of reporting confidence intervals. The case against NHST, which has been made repeatedly in multiple disciplines and is growing in awareness and acceptance, is introduced and discussed. Accounting as an empirical research discipline appears to be the last of the research communities to face up to the inherent problems of significance test use and abuse. The paper encourages adoption of a meta-analysis approach which allows for the inclusion of replication studies in the assessment of evidence. This approach requires abandoning the typical NHST process and its reliance on p-values. However, given that NHST has deep roots and wide ‘social acceptance’ in the empirical testing community, modifications to NHST are suggested so as to partly counter the weakness of this statistical testing method.

This paper advocates abandoning null hypothesis statistical tests (NHST) in favour of reporting confidence intervals. The case against NHST, which has been made repeatedly in multiple disciplines and is growing in awareness and acceptance, is introduced and discussed. Accounting as an empirical research discipline appears to be the last of the research communities to face up to the inherent problems of significance test use and abuse. The paper encourages adoption of a meta-analysis approach which allows for the inclusion of replication studies in the assessment of evidence. This approach requires abandoning the typical NHST process and its reliance on p-values. However, given that NHST has deep roots and wide ‘social acceptance’ in the empirical testing community, modifications to NHST are suggested so as to partly counter the weakness of this statistical testing method.

16 junho 2016

Venda Casada

O Superior Tribunal de Justiça (STJ) garantiu a entrada de clientes em cinemas com produtos iguais ou similares aos vendidos nas suas dependências. Além disto, o cinema não pode fixar cartazes alertando para não entrar nas salas com produtos de outros locais.

O ministro relator do recurso no STJ, Villas Bôas Cueva, destacou em seu voto que a rede de cinema dissimula uma venda casada, lesando direitos do consumidor.

“Ao compelir o consumidor a comprar dentro do próprio cinema todo e qualquer produto alimentício, a administradora dissimula uma venda casada e, sem dúvida alguma, limita a liberdade de escolha do consumidor (art. 6º, II, do CDC), o que revela prática abusiva: não obriga o consumidor a adquirir o produto, porém impede que o faça em outro estabelecimento”, argumentou o magistrado.

Segundo o Tribunal

O recurso da rede de cinema foi parcialmente provido no que tange aos limites da jurisdição. A decisão do tribunal estadual havia estendido os efeitos da sentença para todo o território nacional (eficácia erga omnes da decisão).

Villas Bôas Cueva citou precedentes do STJ para limitar os efeitos do julgado de acordo com os limites da competência territorial do órgão prolator da decisão; no caso, a Comarca de Mogi das Cruzes, no interior de São Paulo.

O ministro relator do recurso no STJ, Villas Bôas Cueva, destacou em seu voto que a rede de cinema dissimula uma venda casada, lesando direitos do consumidor.

“Ao compelir o consumidor a comprar dentro do próprio cinema todo e qualquer produto alimentício, a administradora dissimula uma venda casada e, sem dúvida alguma, limita a liberdade de escolha do consumidor (art. 6º, II, do CDC), o que revela prática abusiva: não obriga o consumidor a adquirir o produto, porém impede que o faça em outro estabelecimento”, argumentou o magistrado.

Segundo o Tribunal

O recurso da rede de cinema foi parcialmente provido no que tange aos limites da jurisdição. A decisão do tribunal estadual havia estendido os efeitos da sentença para todo o território nacional (eficácia erga omnes da decisão).

Villas Bôas Cueva citou precedentes do STJ para limitar os efeitos do julgado de acordo com os limites da competência territorial do órgão prolator da decisão; no caso, a Comarca de Mogi das Cruzes, no interior de São Paulo.

Assinar:

Postagens (Atom)