Not only do his models make you understand key economic concepts in a very deep sense of the word, they also give us common human beings the language to discuss issues we could not discuss before. And to discuss them in a precise way, because he has distilled the essence. Take for example the issue of control. It is as old as Adam and Eve (no doubt she was in control), but it is a slippery concept, which most people interpret in a different way.

It is difficult to have a scientific discussion of control issues, without a scientific definition of what control is and why it matters. And as economists we tend to ignore what we cannot measure precisely. Thus, Oliver’s ability to distill the essence of control has allowed the economic discipline to focus on the issue of control, which is one of the most important issues not just in corporate finance, but in economics in general.

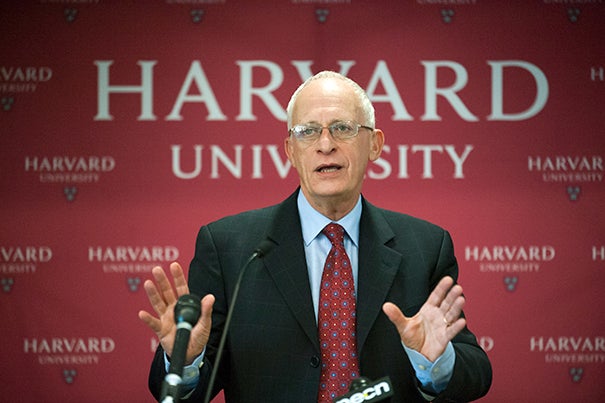

Oliver’s contributions are many and quite spread across different economic subfields, but his most important one, the one he dedicated most of his life to, the one he deservedly received the Nobel prize for, is his work with Sandy Grossman and John Moore on the theory of the firm. As a student of Oliver, I am certainly biased, but I think that the question of what a firm is, what the difference is between producing a widget internally or buying it from an external supplier, is one of the most fundamental questions in economics—a question posed initially by Ronald Coase more than 80 years ago, but a question where very little progress had been made until the beginning of the 1970s.

[...]

Fonte: aqui

Nenhum comentário:

Postar um comentário