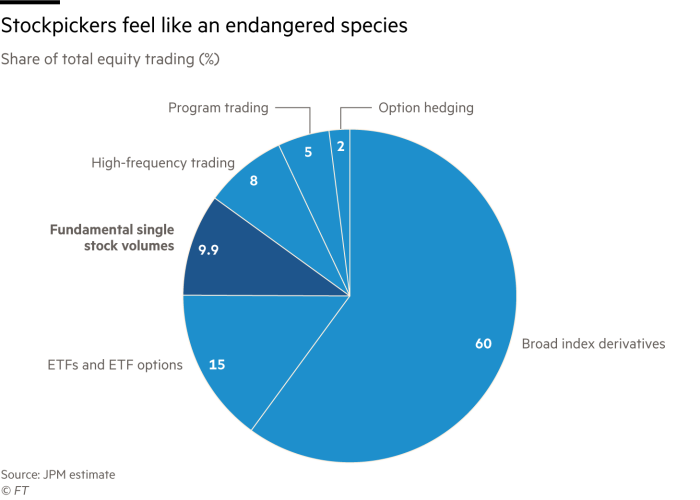

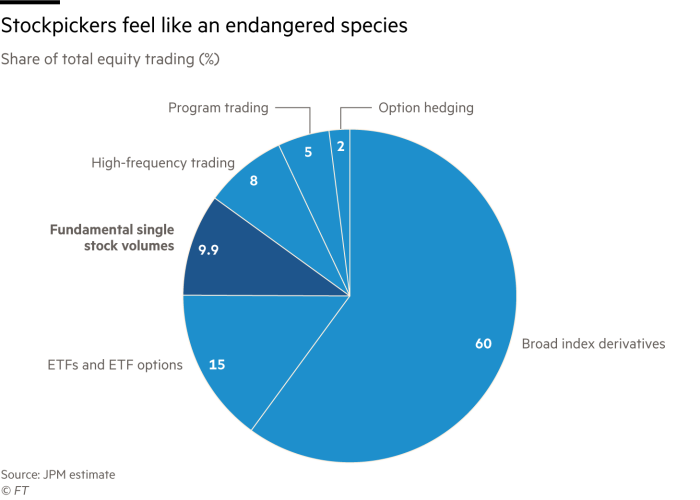

O espaço da análise fundamentalista será cada vez menor num mercado dominado por métodos matemáticos e computacionais:

In late 2013, academics at computer-driven funds giant AQR posted online a research paper called “Buffett’s Alpha.” The paper argued that the returns of the legendary investor could largely be explained by buying stocks that were cheap, safe and high quality — and then using debt to juice returns. The implications were potentially huge. For all the mystique surrounding the investing strategy of the Sage of Omaha, much of it could apparently be replicated by a machine scanning the market for stocks displaying such characteristics. AQR launched a fund that applied this approach to a large basket of global equities. Other quant firms are joining in; London-based start-up Havelock is currently trying to fashion an algorithm that mimics Mr Buffett. Such attempts are helping to undermine what was once a prominent feature of the investing landscape: the cult of the star stock picker.

Also threatening these vaunted operators has been the decade-long equities bull market, fuelled by trillions of dollars of central bank asset purchases, which has boosted the appeal of cheap index-tracking funds. Spotting out-of-favour bargain stocks has been a duff strategy compared with buying and holding stocks already on a roll, or fast-growing technology firms. As a result, many of the former stars have been left looking decidedly ordinary. “Stock pickers just haven’t performed and that’s why investors are pulling out of active managers,” said Kevin Arenson, chief investment officer at Stenham Asset Management, which invests in hedge funds.

Nenhum comentário:

Postar um comentário